ETFs vs stocks

This page is still a work in progress, stay tuned for more details!

ETFs

ETF (Exchange Traded Funds) are investment securities traded like any other stock. However, when buying a share of an ETF, you are actually buying a basket of stocks instead of a single one.

These "baskets" are called indexes, defined by index providers.

Index providers

One of the largest index providers for such ETFs is a company called MSCI, and below is the classification of different markets.

Among the most popular global MSCI indexes are:

- MSCI World Index: tracks the large and mid-cap from the 23 developed markets, covering 1480 companies in total (85% of each country's market capitalization).

- MSCI ACWI Index: tracks the large and mid-cap from the 23 developed markets + the 24 emerging markets, with around 3000 constituents representing 85% of the global investable market capitalization

- MSCI ACWI IMI Index: same as MSCI ACWI, but also covers small-cap, pushing the number of constituents above 9000, covering 99% of the global investable market capitalization

Another large index provider is FTSE:

- FTSE Developed Index: subset of the FTSE All-World Index, with more than 2000 constituents in developed markets.

- FTSE All-World Index: more than 4000 constituents, covering 98% of the world's investable market capitalization.

Finally, the last one I will mention is Solactive, selected by Amundi for its "Prime" ETFs:

- Solactive GBS Developed Markets Large & Mid Cap Index: large and mid-cap from developed markets, around 1500 constituents (~85% of the market cap of these markets).

- Solactive GBS Global Markets Large & Mid Cap Index: large and mid-cap from developed and emerging markets, around 3500 constituents (~85% of the market cap of these markets).

As you can see, different index providers have similar indexes.

| Index Provider | All* | Developed | Emerging |

|---|---|---|---|

| MSCI | MSCI ACWI Index | MSCI World Index | MSCI Emerging Markets Index |

| FTSE | FTSE All-World Index | FTSE Developed Index | FTSE Emerging Index |

| Solactive | Solactive GBS Global Markets Large & Mid Cap Index | Solactive GBS Developed Markets Large & Mid Cap Index | Solactive GBS Emerging Markets Large & Mid Cap Index |

*All = developed + emerging

Index constituents

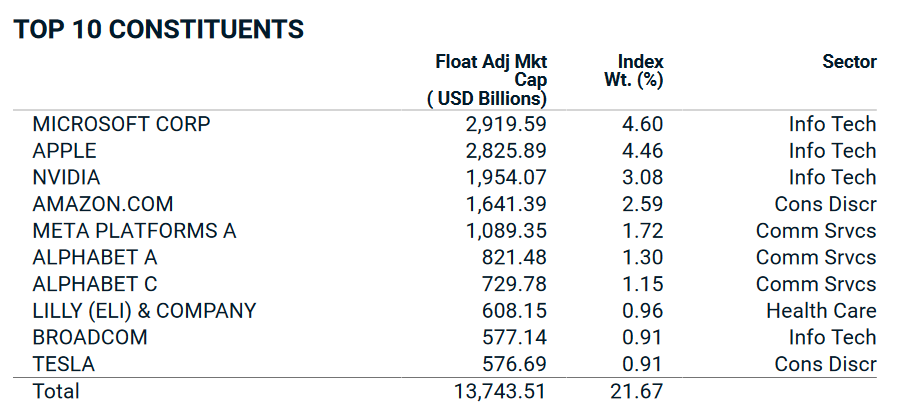

If you buy shares of an ETF tracking the MSCI World Index, here is part of what you are indirectly buying (as of March 8th 2024):

If you buy for 1000€ of that ETF, it is equivalent to buying:

- 46.0€ of Microsoft

- 44.6€ of Apple

- 30.8€ of Nvidia

- 25.9€ of Amazon

- etc.

This is the main benefit of investing through ETFs: you can instantly diversify without having to buy hundreds of stocks yourself.

Pros

- ETFs provide instant diversification: a single ETF can represent thousands of constituents.

- ETFs can provided exposure to specific countries, sectors, industries, without having to manually pick indivual stocks.

- ETFs are as easy to buy as stocks, and share prices are usually quite affordable.

- ETFs have low fees: traditionnal mutual funds usually underperform, charging annual fees that can be 10x those of ETFs.

- Accumulative ETFs automatically reinvest the dividends, avoiding any laborious tax filing.

Cons

- ETFs cannot beat the market: they are the market. Howver, consistently overperforming a broad index is almost imposible for an individual investor.

- Lots of indexes share similar top holdings: the top 10 of the MSCI World Index or MSCI USA Index are the same (the USA represent 70% of the MSCI World).

- Some ETFs can make you overly exposed to a few companies. For example, the MSCI World Information Technology Index has 19% of Microsoft and 18% of Apple (as of March 18th 2024). It can get worse: the MSCI Denmark Index is 66% invested in Novo Nordisk!

Stocks

Stocks are individual components of an ETF. If you want exposure to Microsoft, you can buy an ETF holding Microsoft in its index, or simply buy a share of Microsoft directly.

Dividends

Dividends are cash payments to shareholders, usually when a company does not have enough opportunities to reinvest the profits it generates.

Dividends payments do not make you richer in any way! When a dividend is detached, the stock price drops by the same amount.

It works like withdrawing money at an ATM: if a company decides to distribute $1/share in dividends, from a stock trading at $50, you end-up with $1 in cash (minus taxes) + $49 in stock.

What is to like about dividends is mostly the passive income stream that they can generate: most US-based companies pay them on quarterly basis, so you can receive regular cash payments without having to sell any share.

Pros

- Individual stocks lift any restriction that ETFs have: you can buy stocks for any size of publicly-traded companies, from any country.

- You know exactly which companies you have in your portfolio.

- Individual positions can achieve levels of performance that ETFs cannot match: Nvidia as has a grown almost 20-fold in just 5 years.

- No management fees.

Cons

- Due diligence is mandatory: you have to invest time to research about the companies you buy, monitor the business, its competitors, the industry, the trends, risks etc.

- Overconcentration is a risk: having more significant exposure to few companies makes your portfolio less resilient. A rule of thumb recommends owning around 25 stocks, spread across various sectors.

- Individual stocks are triggering more tax events: you will have to declare profits, losses and dividend payments.

- Some share prices can be so high that buying a single share represent a significant amount: the Broadcom stock is currently trading above $1200 while Hermès is pushing towards 2500€.